Ripple (XRP) is one of the most trending cryptocurrencies at the moment. The token worked all the way to reach the top of the market radar, but it cannot pass the pedestal at a price of $3. Will the looming interest rate reduction scenario serve as a launchpad for tokens to surge to new highs? Let’s look into it.

If rate cuts are announced on September 17th, analysts will take up major cryptocurrencies

Leading cryptocurrency analyst Justin Wu shared how major cryptocurrencies will rise if rate cuts are announced next week. Starting with Bitcoin, the forecast for the looming cut is already beginning to show signs of effect, with Bitcoin sitting at $115,000. Meanwhile, Ethereum is surged to sit at $4,508.

In addition to this, WU quickly added how XRP coordinates with rate reduction developments, already breaking the $3 price mark. If the market momentum prefers tokens, XRP can easily break the $4 price mark.

“Bitcoin expects fuel gatherings, so Bitcoin will reach $115,000. Ethereum will rise to $4,502 and whales will leave the exchange. XRP will break $3. It appears to be aiming for $4.

Bitcoin is $115K BCZ FED Rate Reduction Fuel Gathering

Ethereum climbs $4,502 and the whales leave the exchange

It looks like XRP is breaking $3 and is aiming for $4.

Big movements, big opportunities are approaching!

Do you want to participate in this too? pic.twitter.com/mz5tu5j3ih

– Justin Wu π (@hackapreneur) September 12, 2025

Where is XRP heading this September?

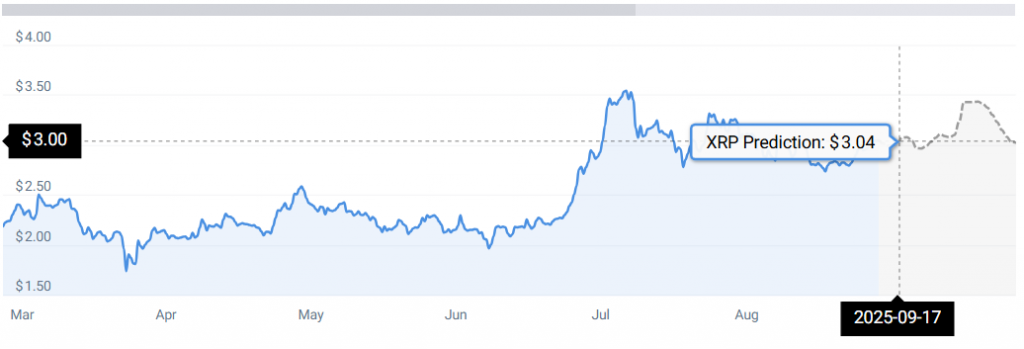

According to Concodex XRP statistics, XRP may expect a regular priced pedestal of $3.04 by September 17th.

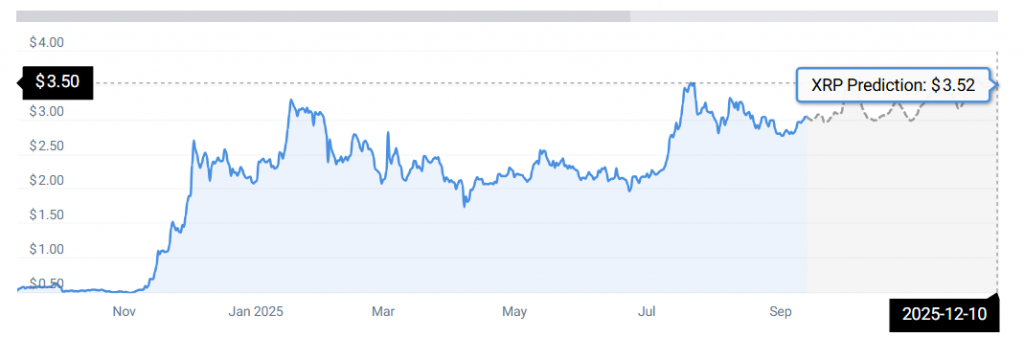

The token is expected to reach a high of $3.31 by October 2025 and then explore a new, high-priced spot of $3.51 by December 2025. The launch of XRP ETFs may play a key role in affecting token prices. This development could help the token ultimately reach $4 in the process.

“According to current XRP price forecasts, XRP prices are projected to rise 14.94% to $3.51 by December 11, 2025. According to technical indicators, current sentiment is bullish. Time to buy XRP.”