Since ChatGPT was announced three years ago, analysts, technologists, and even Google engineers and the company’s former chief executive have declared that Google is falling behind in the high-stakes race to develop artificial intelligence.

No more.

The internet giant has released new AI software and signed deals, including a chip partnership with Anthropic PBC, reassuring investors that the company won’t easily lose to ChatGPT creator OpenAI and other rivals.

Gemini 3, Google’s latest multipurpose model, was quickly praised for its inference and coding capabilities, as well as the niche tasks that have stumbled AI chatbots. Google’s cloud business, which it once ran, has been steadily growing, thanks in part to the global rush to develop AI services and demand for computing.

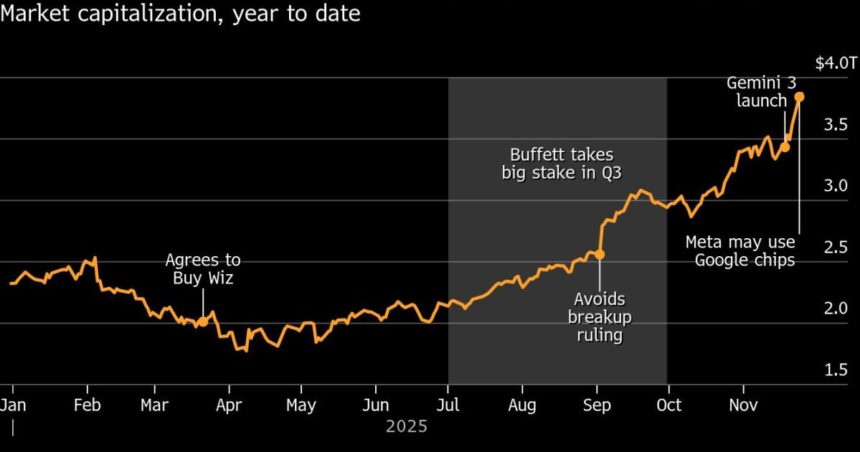

There are also signs of growing demand for Google’s specialized AI chips, one of the few viable alternatives to Nvidia’s dominant product. Shares of parent company Alphabet Inc. soared on Monday after reports that Metaplatforms Inc. was in talks to use Google’s chips. The company’s market capitalization has increased by nearly $1 trillion since mid-October, helped by Warren Buffett’s $4.9 billion stake in the third quarter and Wall Street’s broader enthusiasm for its AI efforts.

Shares of Google owner Alphabet rose as much as 3.22% in New York trading on Tuesday. The company is on track to reach a market capitalization of $4 trillion for the first time.

SoftBank Group, one of OpenAI’s biggest backers, fell to a two-month low on Tuesday on concerns about competition from Google’s Gemini. Nvidia stock fell as much as 5.51% on Tuesday, wiping out $243 billion in market capitalization.

“Google has definitely always been the dark horse in this AI race,” said Neil Shah, analyst and co-founder of Counterpoint Research. It is a “sleeping giant fully awake.”

Google executives have long argued that expensive, in-depth research will help the company fend off rivals, maintain its position as the leading search engine and invent tomorrow’s computing platforms. Then along came ChatGPT, which posed a real threat to Google Search for the first time in years, even though Google pioneered the technology behind OpenAI’s chatbots. Still, Google has many resources that OpenAI doesn’t have. A corpus of data ready for training and improving AI models. Flowing profits. and its own computing infrastructure.

Google and Alphabet CEO Sundar Pichai told investors last quarter that “we’ve taken a comprehensive, thorough, full-stack approach to AI.” “And it actually works.”

Concerns that Google will be held captive by regulators are waning. The company recently avoided the most serious outcome of a U.S. antitrust lawsuit, a breakup, in part because it recognized the threat posed by new AI entrants. And the search giant is making some progress in its long-term effort to diversify beyond its core business. Waymo, Alphabet’s self-driving car division, just entered several new cities and added highway driving to its taxi service, a feat made possible by the company’s extensive research and investment.

Part of Google’s advantage comes from its economics. The company is one of the few companies in the industry that makes what is called a full stack of computing. Google creates the AI apps, software models, cloud computing architectures, and underlying chips that people use, including the popular Nano Banana image generator. The company also has a treasure trove of data to build AI models from search indexes, Android phones, and YouTube, which Google often keeps in-house. That means, in theory, Google has more control over the technical direction of its AI products, and unlike OpenAI, it doesn’t necessarily have to pay suppliers.

Several tech companies, including Microsoft Corp. and OpenAI, are planning ways to develop their own semiconductors or develop relationships that would reduce their dependence on Nvidia’s best-selling products. For years, Google was effectively the only customer for its own processors, called tensor processing units (TPUs). The company first designed this processor more than a decade ago to speed up search result generation and has since adapted it to handle complex AI tasks. That is changing. In October, AI startup Anthropic announced it would use up to 1 million Google TPUs in a deal worth tens of billions of dollars.

On Monday, technology publication Information reported that Meta plans to use Google chips in its data centers in 2027. Google declined to discuss specific plans, but said its cloud business is seeing “accelerating demand” for both custom TPUs and Nvidia graphics processing units. “We remain committed to supporting both, as we have for many years,” a spokesperson said in a statement.

Mehta declined to comment on the report Monday night.

“We are pleased with Google’s success,” an Nvidia spokesperson said in a statement Tuesday. “They are making great strides in AI, and we continue to supply Google,” the spokesperson added. “NVIDIA is a generation ahead of the industry. We are the only platform that can run any AI model and run it anywhere computing happens.”

Analysts see metanews as a sign of success for Google.

“Many other companies have failed to develop custom chips, but Google clearly can add a new twist here,” Ben Barringer, head of technology research at Quilter Cheviot, said in an email.

Google took a risk to get here. In early 2023, Google consolidated its AI efforts under Demis Hassabis, head of London AI lab DeepMind. This personnel change came with some challenges, most notably the failure to roll out the image generation product.

For several years, DeepMind pursued research in areas such as protein folding that led to new commercial strategies (and Nobel Prizes), but contributed little to Google’s revenue. Under the reorganization, the AI unit is focused almost squarely on foundational models that align with OpenAI, Microsoft, and others.

Hassabis, a prominent computer scientist, has been instrumental in retaining key AI engineers despite multimillion-dollar offers from rivals. His boss, Mr. Pichai, is willing to splurge on talent.

Gemini 3 Pro has risen to the top of the featured AI leaderboards on LMArena and Humanity’s Last Exam. OpenAI founding member Andrei Karpathy said this is “clearly a Tier 1 LLM,” referring to large-scale language models. Google has pitched the model as one that can solve complex science and math problems and address thorny issues such as the generation of misspelled images and overlaid text that can prevent enterprise customers from adopting AI services more broadly.

Gauging consumer interest is even more difficult. Google announced last week that 650 million people use the Gemini app. OpenAI recently announced that ChatGPT has reached 800 million weekly users. As of October, Gemini’s app had 73 million monthly downloads, compared to ChatGPT’s 93 million monthly downloads, according to research firm Sensor Tower.

Google is an advertising giant, but it has historically struggled to find other commercial models. The company reported third-quarter revenue for its cloud business of $15.2 billion, an increase of 34% year over year. Still, it ranks third behind Microsoft and Amazon Web Services, which more than doubled Google’s cloud revenue in the most recent quarter. Counterpoint Research’s Shah said Google’s adoption of AI in enterprises has lagged behind Microsoft and Anthropic.

Meanwhile, OpenAI aims to make money by selling a premium version of ChatGPT and adjacent software to enterprises. The company has signed deals with chipmakers ranging from Broadcom to Advanced Micro Devices to Nvidia to support its AI ambitions.

Google’s TPUs are primarily attractive to a small number of companies, such as Meta and Anthropic, that have large computing costs, said Meryem Arik, CEO of AI startup Doubleword.

And the chip industry “is not a zero-sum game with only one winner,” Ballinger said.

First, AI developers can only access Google’s chips through the company’s own cloud service. More flexibility in using Nvidia’s graphics processing units (GPUs). “As soon as you use TPU, you’re locked into the Google cloud ecosystem,” Arik says.

Being tied to a single supplier may be something companies have been avoiding. Thanks to advances in AI, that’s no longer the case with Google.

“It’s safe to say Google is back in the game with Gemini 3,” said Forrester analyst Thomas Hasson. “In fact, to paraphrase Mark Twain, reports of Google’s death have been widely exaggerated, if not irrelevant.”

Bergen and Parnell write for Bloomberg. Henry Wren, Rose Henderson and Phil Kuntz contributed to this report.