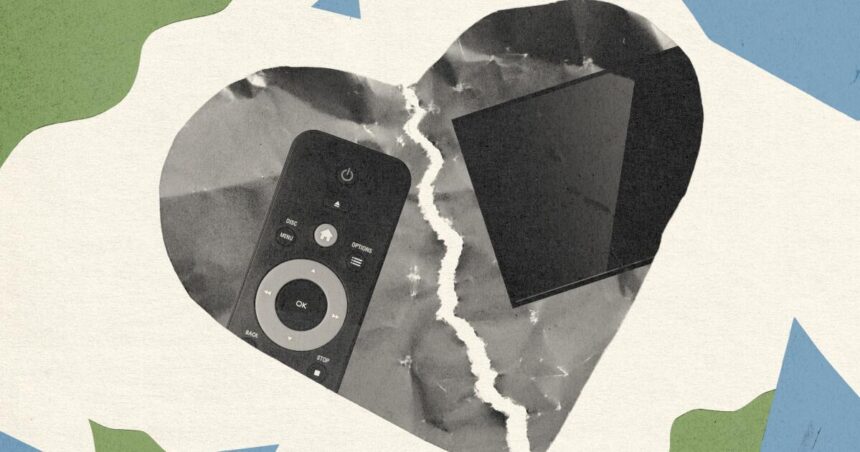

By the time you read this article, The Walt Disney Company and DirecTV may have resolved their dispute. Or they may not, leaving 11 million customers still without access to ESPN, their local ABC station, and many other channels.

Amid the media giants’ battle of wills, DirecTV subscribers missed Aaron Rodgers’ return from a season-ending injury last year when the New York Jets played the San Francisco 49ers on “Monday Night Football.” That is, unless viewers decide to switch providers or cut the cord in favor of YouTube TV or Hulu + Live TV. Disney has been in similar disputes in the past, and those options are a key source of leverage for the company in this one.

Once the issue is resolved and both sides have declared victory, there will be plenty of time to analyze who came out on top and which companies came into the battle with the best hand.

Was it the Burbank-based entertainment giant with its essential sports and children’s programming? Or was it the long-struggling El Segundo satellite TV operator, which had every incentive to hold on tight with subscriber numbers already plummeting?

As many have noted, this collision comes at a particularly ominous time for the pay-TV business. Viewers are quickly abandoning their cable and satellite packages. DirecTV needs sports programming from companies like Disney, which is the only way to keep traditional pay-TV bundles afloat. Unlike Charter, which has a lucrative broadband division, DirecTV has no other business to fall back on.

Disney wants higher fees from DirecTV to cover rising programming costs caused by the increasing amounts the Mouse House must pay the NBA and NFL to broadcast their games. The company also wants to enforce “minimum penetration” thresholds on channels to keep subscriber numbers high. At the same time, the company also plans to move much of its entertainment content out of the bundle and onto streaming services Disney+ and Hulu, and to sell its flagship ESPN channel directly to cord-cutters.

Taken together, it’s a recipe for conflict.

But one of the darkest recent omens for the entertainment industry came in the context of another lawsuit: one over a planned, yet-to-be-launched joint venture between Disney and Warner Bros., Discovery and Fox.

To recap, the three media conglomerates announced Venu in February as a way for people to access sports programming without a cable subscription. The venture planned to charge fees.

Fubo, a streaming service that aggregates live sports-focused channels, sued, arguing that the strategy was anti-competitive. Fubo argued that its contracts with programmers prevented it from launching sports-focused “skinny bundles.” Now those same companies are launching their own sports-only products that could threaten the company’s business.

That’s unfair, Hubo said, and a federal judge agreed last month, temporarily blocking Venu’s launch, saying Hubo was likely to prevail on the merits of the case.

That in itself is bad news for Disney, Warner Bros., Discovery and Fox. But the Hubo decision may actually have even more significant implications than it might seem at first glance. In her decision, U.S. District Judge Margaret Garnett dismissed the widespread practice of bundling channels together, seemingly casting doubt on a strategy that forms the bedrock of the pay-TV industry as we know it.

“Taken together, it is difficult to avoid the conclusion that these practices are bad for consumers,” Garnett wrote in the ruling. “These mind-boggling costs not only hurt the wallets of sports-loving consumers who are forced to pay for non-sports channels they don’t want, but also hurt customers who only want entertainment channels but are forced to pay substantially higher costs because they need them — for the most expensive of all content: sports that aren’t being watched.”

Of course, the practice at issue – that distributors, and therefore consumers, must pay for a large number of channels they don’t watch in order to get a limited selection of programming they actually want – is exactly the way the television industry has always operated. It’s worked for decades. To be sure, Garnett makes it clear that in granting Hubo’s preliminary injunction, she’s not actually judging the legality of the entire bundle; that judgment must be made at trial. Moreover, she is careful throughout her ruling not to lean too far to one side or the other.

But even subtly questioning the legality of bundling is sure to raise a few eyebrows in Hollywood.

Indeed, Garnett’s comments did not escape the attention of analysts at MoffettNathanson, who have most closely documented bundling’s slow but accelerating demise. “Not only is it likely that Venu will never see the light of day,” the analysts wrote in a client note issued last week, “Venu’s amateurish go-to-market strategy may have set in motion a tumble toward the complete collapse of the pay-TV model as we know it.”

DirecTV cited Garnett’s ruling in a complaint filed with the Federal Communications Commission over the weekend, alleging that Disney acted in bad faith during negotiations. The document alleges that Disney demanded DirecTV agree not to sue, preempting a lawsuit similar to that against Fubo.

Like Fubo, DirecTV wants the option to offer customers smaller channel packages that are less expensive and more tailored to viewers’ tastes and interests. The company claims that Disney “wants to force DirecTV to deliver a ‘fat bundle’ that includes less desirable Disney programming, while at the same time offering cheaper, ‘skinny’ bundles of programming that consumers want.”

Disney has denied those allegations and said DirecTV misrepresented the facts about the negotiations. Disney Entertainment co-chairmen Dana Walden and Alan Bergman and ESPN chairman Jimmy Pitaro said in a statement that they “believe there is a path forward that strikes this important balance and reaches a fair and flexible agreement that works for all sides, especially consumers.”

Subdued press releases are the norm in a fight like this, especially during a high-stakes football broadcast, but given what’s going on with DirecTV, Disney and the industry at large, it’s clear this isn’t just any old-fashioned horse-and-carriage dispute.

What we wrote

Ramos and Univision are parting ways after a mutual agreement not to renew the popular journalist’s contract.

The “First Take” star has been addressing issues beyond sports through his podcast and cable news networks, some of which he offers as a contributor, he said.

Pressman Films, the studio that produced “Thank You for Smoking” and “The Crow,” is looking to raise money for its upcoming development plans through crowdfunding, a variation of a tactic used by other companies.

Nearly three years after Alec Baldwin accidentally shot “Lust” cinematographer Halina Hutchins, prosecutors have asked a judge to reconsider dismissing the manslaughter case against the actor.

Aishimi:

Week Number

Big money, big influence.

Larry Ellison, one of the world’s richest people, will become a controlling shareholder in Paramount Global once a long-awaited deal with his son’s entertainment company, Skydance Media, is completed, pending regulatory review. After the deal, Ellison’s investment vehicle will own Pinnacle Media, the Massachusetts company that holds the Redstone family’s voting shares in Paramount.

The remaining 22.5% of NAI will be transferred to an entity called RB Tentpole, which is controlled by RedBird Capital Partners, the private investment firm of Jerry Cardinale, the Ellisons’ partner in the Paramount deal.

Ellison provided the bulk of the $8.4 billion that made up the Skydance-Paramount deal, with $2.4 billion going to repay Shari Redstone and her family, and the remaining $6 billion going to other Paramount shareholders and the company’s balance sheet. As part of the deal, Paramount will absorb Skydance at a valuation of $4.75 billion. The company is in the midst of going major.

The filing was triggered by FCC rules requiring Paramount’s prospective buyer to seek federal approval to transfer control of the operating licenses of the company’s 28 owned-and-operated CBS television stations.

In their filing, the Ellisons and Redbird argued that the capital infusion from the deal would “strengthen and revitalize” Paramount’s current broadcast services, and because the companies don’t currently own any other broadcast stations, they said the acquisition “will not result in less competition or other harm.”

Cinematography

According to FilmLA data, production in Los Angeles was essentially flat week-to-week and down significantly compared to last year.

Finally…

Check out this excellent interview with the musician published by The Times on the occasion of his new album with the Bad Seeds, Wild God.

In our “one for me” column, we’re enjoying Phoenix death metal band Gatecreeper’s latest release, ” Use it to get you through your latest workout, but make sure you stay hydrated.