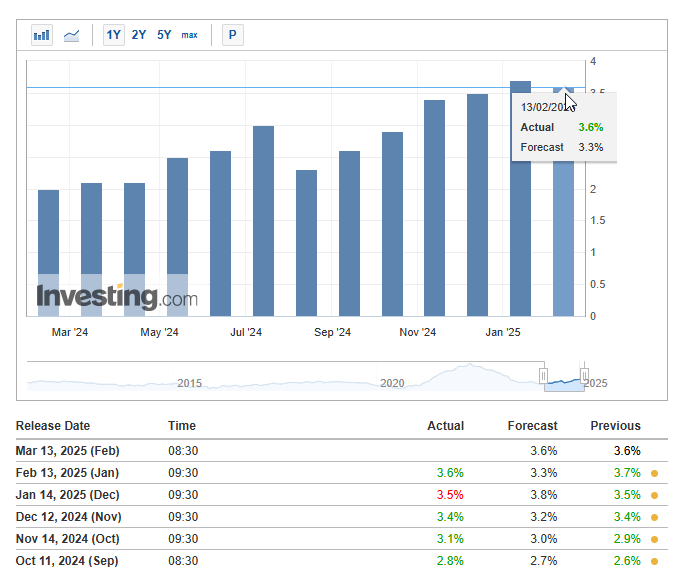

Core PPI data at the time of writing catalyzed a 0.3% increase in January, with several key indicators highlighting sustained economic pressures in various key sectors. The comprehensive PPI report reveals 3.6% metrics from the previous year, surpassing the forecast forecast of 3.3% across multiple key economic segments. This represents a small strategic cut from 3.7% in December, but continues to show sustained inflationary momentum in the early 2025 economic situation.

Just: core US core PPI drops to 3.4%, lower than expected.

– watcher.guru (@watcherguru) March 13, 2025

Analyzing the trends of core PPIs and their impact on inflation and economics

The producer price index for final demand rose 0.4% in January, services increased 0.3%, and goods increased 0.6% in a number of key market segments. The Core PPI has maintained an upward trajectory from 2.8% in September 2024, suggesting sustained production pipeline inflation across several key economic indicators.

The US Bureau of Labor Statistics reported:

“PPI is considered to be a key indicator of consumer inflation, as producers pay more for goods and services are more likely to pass on higher costs to consumers.”

The service in interim demand in January actually fell by around 0.2%, while the processed products increased by 1.0% solids, while the raw products increased by 5.5% in various major industry segments. Interestingly, business loans fell sharply by 7.7%, while freight trucking increased by 1.3%, revealing the impact of various sectors that we have been watching through multiple important business channels.

Data for February 2025

The US core PPI is classified as 3.4%, lower than expected in some major market forecasts. The chart shows the PPIs for the final demand component with a one-month change in February 2025. The products registered a positive change of about 0.3%, while the services showed an increase of about 0.1% in various major economic sectors.

Market expectations for rate reductions have changed since January data, through many important policy adjustments. The Fed faces a tougher path due to sustained producer price pressure. This usually comes before the consumer inflation trends that are closely watched in future releases across multiple key economic indicators.